_______________________________

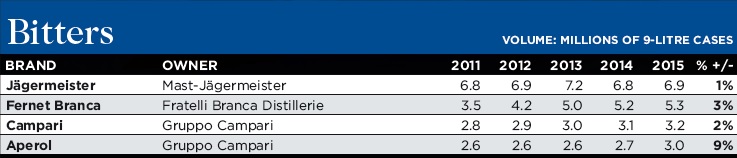

All four bitters brands are in growth. Jägermeister has recovered from a shaky 2014 and, while it’s not back to its 2013 high, it has stopped decline and further distanced itself from its closest rival, Fernet Branca. It returned to growth in its most important market, the US, and experienced dynamic growth in markets such as Spain and France. Euromonitor’s Jeremy Cunnington says the latter market was a key driver for the “most dynamic bitters brand, Aperol”.

Fratelli Branca Distillerie and the two Gruppo Campari brands continued to experience some growth in 2015. The former’s was unhurried due to the slowing of its core Argentinian market. Sales, however, remain strong in Latin America and are growing in the US, Europe and Australia.

Campari saw steady sales growth with an increase of 1.6%. It did particularly well in the UK and the US. These sales, and double-digit growth in Argentina, Spain, Jamaica and Canada “more than offset” the weakness in Brazil and Germany and the decline in Nigeria, due to macroeconomic weaknesses.

Gruppo Camapari reported Aperol’s sales were boosted by continued double-digit growth in the US, France, UK and Spain as well as in its “seeding markets” – eastern Europe, Australia and Brazil. Most importantly, Gruppo said, Aperol stabilised in Germany.

For Cachaça, flat is good. The fact that many of the leading brands managed to maintain volumes and in Velho Barreiro’s case see 1% growth is somewhat of an achievement as the Brazil-centric category continues its long-term decline. Cunnington says: “This has meant increased consolidation whereby a category dominated by numerous small local brands a decade ago is increasingly dominated by big brands such as those in the list.” After 8% growth in 2014, Diageo’s Ypióca falls below 2012 levels this year with an impressive 27% loss.