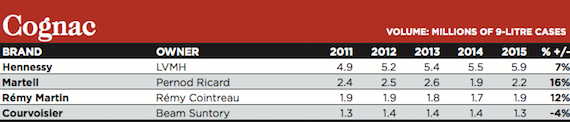

The glass is definitely half full when it comes to the cognac category, with half the million-case brands experiencing double-digit growth in 2015.

The pessimists might point out that sales were down 2% globally last year, but analysts have cause for optimism as the US continues to turn to cognac and the Asian market bottoms out. Euromonitor International predicts global brandy and cognac sales will grow 15% in the next five years.

Back to the present, Hennessy has been the exception to the rule, growing at a time when all the other global players haemorrhaged sales or, at the very least, flatlined. LVMH’s brand continued to experience growth in 2015 and further distanced itself from its closest rival, Martell. The Pernod Ricard-owned cognac was a big casualty in 2014 as sales plummeted 27% and it fell below 2m cases for the first time in five years.

It was in danger of being toppled by Rémy Martin had it continued on this path but double-digit growth in its 300th year has resuscitated the brand.

Rémy Martin has reclaimed its 2m cases and is back to 2011/12 highs. Beam Suntory’s Courvoisier is the only cognac that failed to eke out growth last year.

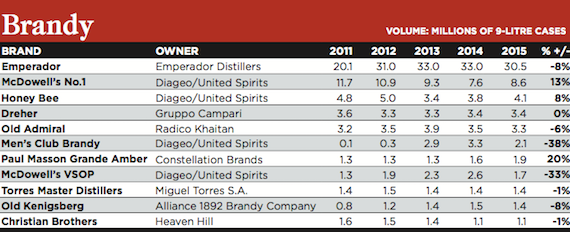

With only two brands in growth, one flat and seven in decline, brandy brands continue to be at the mercy of their local, single market. The boom in cognac in the US has spread to brandy, according to Euromonitor’s Jeremy Cunnington, even if it’s only extended as far as the leading brands. Weak market conditions in India (not helped by prohibition in Kerala) and the Philippines have left their mark.

Diageo/United Spirits’ two biggest sellers have returned to growth following a turbulent couple of years. Honey Bee has its buzz back after being stung in 2013, and McDowell’s No.1 has cause for celebration after recovering most of its lost sales in 2015.

The same cannot be said for its VSOP as sales plummeted 33%. Men’s Club, a fastest grower in 2014, fell by double digits. With a 37-strong Millionaires’ Club portfolio, the major player is bound to falter in some sectors – two of four brands in growth in this category ain’t bad. But maybe that’s the optimist talking.