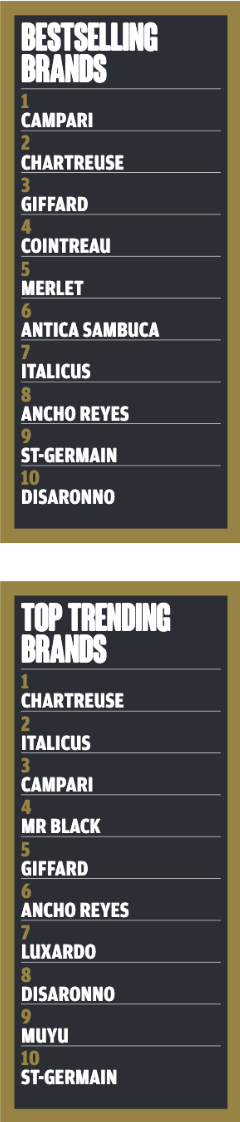

But Campari has a forecourt full of popular vehicles – the Boulevardier, Americano and Jungle Bird all make our 50 classics ranking this year and all call for this distinctive red bitter liqueur. In 18% of bars it was the top liqueur and on the podium in 38% of cases, but there will be few bars that don’t stock Campari at all. While other brands have competitors, Campari is Campari.

But Campari has a forecourt full of popular vehicles – the Boulevardier, Americano and Jungle Bird all make our 50 classics ranking this year and all call for this distinctive red bitter liqueur. In 18% of bars it was the top liqueur and on the podium in 38% of cases, but there will be few bars that don’t stock Campari at all. While other brands have competitors, Campari is Campari.

Chartreuse, the herbal French liqueur, is another bartender favourite. Nothing quite adds the botanical boost to a cocktail like this monk-made potion. It was only found to be the most poured liqueur in 6% of cases, but that’s not surprising. It is, though, in the top-three roster of liqueurs in a fifth of the sample. Much more likely to be the go-to brand of liqueur is Giffard, which, of course, has the advantage of a range of 50-odd expressions. 10% of respondents reach for Giffard as their number one liqueur brand, while 14% put it among their top-three choices.

Cointreau, leader of the orange-based liqueur category, says our poll, came in fourth with similar numbers, though was more likely to be part of the supporting cast than the leading light. While it is called for in a number of classics, the brand is not without its competitors. Merlet, a range majoring on fruit liqueurs, comes in fifth, while Antica Sambuca is just behind in sixth.

Perhaps the story this year is Italicus, which debuts in the list and follows up on last year’s trending appearance. The liquid pays homage to the Italian tradition of rosolio liqueurs and has undoubtedly found traction with bartenders. With founder Giuseppe Gallo now working alongside new owner Pernod Ricard, we can expect the brand to rise up the charts. Second in the trending list certainly suggests so. Chile liqueur Ancho Reyes, elderflower number St-Germain and Amaretto-like Disaronno, which complete our list, all own their niche.

*The Trending list was updated 13/01/2021 after Drinks International became aware of an administrative error.

Methodology

The results of this report are the culmination of a questionnaire of 106 bars around the world, each cherry-picked to take part based on their performance in global bar awards. We aim to find out not only which brands sell best but also what’s trending. These two data sets give us an insight into the brands that are doing the most volume and the brands that are hot right now.

To read more on the methodology of the Brands Report click here.