Indian whisky is a mixed ride of thrills and ills. Each year we check in on the category there are brands that have rapidly climbed the market with seemingly no end in sight, and there are those experiencing that sick-to-their-stomach feeling as the big dip bites. As ever, Indian whisky is a rollercoaster.

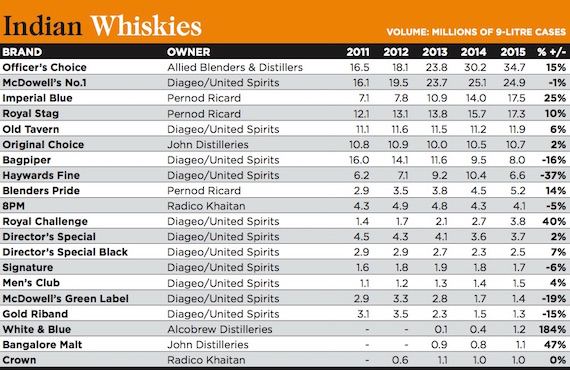

This year 11 of 19 Indian whisky million-case brands are in growth. But first to the category leader, Officer’s Choice. The Allied Blenders brand has carved another 4.3m cases out of the market this year, taking it’s output to 34.7m cases.

The route to success in Indian whisky is over- delivering within a brand’s segment. Officer’s Choice has performed that trick with aplomb over recent years. Its standard core brand brings in the numbers but success has also been found with its ‘semi-premium’ Blue edition and ‘semi-premium-plus’ Black variant. Each looks to capture a different piece of the Indian whisky jigsaw.

McDowell’s No.1 looks a long way back in second now. In 2013 it was just 0.1m cases behind Officer’s Choice, now it is almost 10m cases adrift. Still, maintaining 25m cases in a market of low consumer loyalty is no easy task. Diageo’s top selling whisky remains a good distance from Pernod Ricard’s leading duo, Imperial Blue and Royal Stag, which are now around the 17m case mark. Both brands are growing nicely with 25% and 10% hikes each last year, but no brand in India can fall complacent.

Diageo’s Bagpiper is testament to how things can rapidly deteriorate. The brand sells just half of the 16m cases it did in 2011, suffering more double-digit decline in 2015. In theory the consumer pool in India should be increasing as society gets richer, liberalism pervades and new LDA consumers join the category, but for now volume sales of whisky are flat at about 171m cases.

Most of the ups and downs in the Indian whisky category are from hungry, agile brands cannibalising sales. But green grass may grow again – Euromonitor International forecasts a 20% increase in volumes by 2020.