The 2015 results don’t overwhelmingly bear the trend out, but there are underlying moves in scotch towards lower-priced brands. Diageo has spoken of its strategy for ‘mainstream brands’, with more effort and marketing now to be directed towards the cheaper journeymen of its portfolio. Pernod Ricard, meanwhile, has refocused its sights on occupying the ‘centre ground’.

This is a shift from the dogmatic premiumisation drive of years past and is down to faltering emerging markets – essentially not everyone can afford premium products. If trends continue in many key emerging markets (Latin America: recession and political instability, Russia: currency devaluation and EU sanctions; China: government clampdown), these lean, once-neglected brands, will increasingly fill the breach that premium left behind.

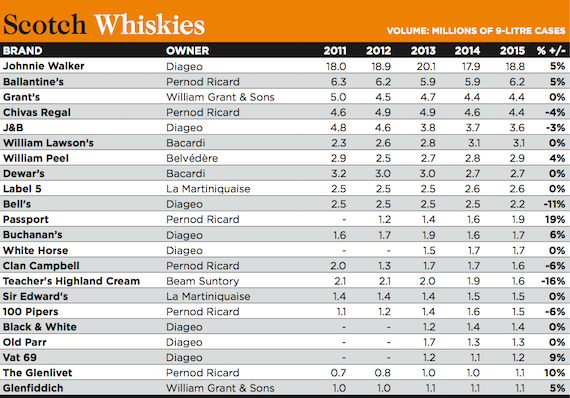

According to Euromonitor Interntaional’s Jeremy Cunnington, many of the million-case brands that managed to find growth in 2015 tended to be those “focused at the lower price points such as Passport and VAT 69”.

Johnnie Walker and Balantine’s growth were both driven by “lower priced variants”, adds Cunnington. Walker, as a brand of many parts and price positions, can follow the direction of the wind, and managed growth of 5%, driven by positive trends in Latin America, Europe and Asia. But it’ll take growth of a couple of percentage points more next year to see the brand equal its 2013 peak of 20.1m cases.