The growth of mixers – driven as it has been by premiumisation – has brought a broad church of styles and flavours, as brands seek to engineer the next big spirit-mixer trend, the sequel to the G&T.

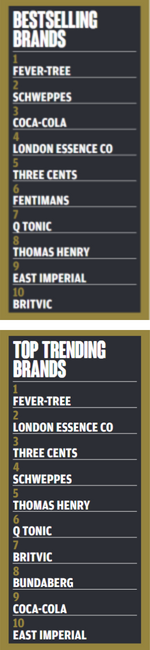

Fever-Tree – itself now well-diversified – remains the reference for quality-end mixers. It is the house mixer in a third of our sample, boasting one of the largest shares in the Brands Report. Threequarters of those that stock three mixers have Fever-Tree among the roster, presumably in answer to the Fever-Tree bar call, which clearly does still happen. Just look at our Trending list – Fever-Tree still tops it.

Schweppes, through various premium lines and global distribution, has always been second since we’ve been polling. Half as many bars as Fever-Tree made it their top mixer – 16% – but it was available in more than a third of our sample.

Cola remains unfinished business for most mixer brands, try as they might to nibble away at the leader, Coca-Cola. One day, perhaps, but not today. Coca-Cola, off the back of just selling cola, is third in our list. No doubt it’d be higher in mainstream bars, but here, in the cocktail bar, Coke (helped though probably not driven by its Signature range) is the first called-upon mixer in 8% of bars and among the top three in more than a third.

As Fever-Tree becomes ever more mainstream in mature markets, it is left a little exposed, with top bars increasingly looking towards brands with smaller footprints. In fourth (and second in our Trending list), Britvic-owned London Essence is a good example of a brand trying to out-premium premium, with 10% of our sample making it their house and a quarter making it among their top three.

Greek brand Three Cents, recently bought out by the Coca-Cola Company, was founded by bartenders and has a knack for coming up with flavour profiles loved by the trade. It was a top-three brand in more than 20% of bars. Meanwhile, English heritage brand Fentimans, with its Victoriana vibes, was a top-three mixer in 18% of our sample. Q Tonic had a relatively high proportion of house pours (5%), while Germany’s answer to Fever-Tree, Thomas Henry, was a top-three choice in 11% of bars. East Imperial (7%) and Britvic (5%) made up our top 10.

How we did it

The Annual Brands Report results are the culmination of a survey of 100 bars from 33 countries around the world which have been nominated or won international awards. The report offers a picture of the buying habits of the world’s best bars – not only which brands sell best, but also what’s trending to indicate the brands that are hot right now.

To view the page-turner edition of the Brands Report click here.

The Brands Report will be serialised on drinksint.com throughout January.