.........................................................................

Vodka might be as flat as a pancake with projected global growth at 1% in the next five years, but any growth from such a large base is significant. Vodka is not in renaissance and doesn’t receive the kudos of its fellow white spirits but it does boast an impressive one third of the brands in this exclusive Millionaires’ Club.

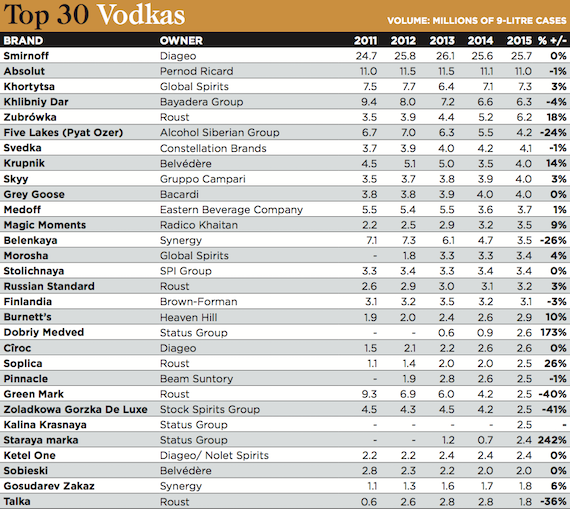

“Vodka continues to be led by the two best-known brands, Smirnoff and Absolut,” Euromonitor’s Jeremy Cunnington says. “Both struggled for growth in their core markets, but were boosted by good growth in others.”

Last year, Smirnoff global brand director Matt Bruhn was vocal about category leaders’ failures. He said introducing a raft of flavoured vodkas into the market that tasted the same was a mistake. “Adding 42 flavours, all of which are almost the same, was a bad decision. As our competitors entered the market and took prices down it left us open to attack. We stop bringing on new consumers, stop challenging the market and offering new experiences for new occasions. Vodka followed our lead – more flavours, more copycat brands, less true innovation – and allowed other products to take the lead,” Bruhn said.

Despite this, Diageo was able to recover sales and grow ever so slightly in 2015. Pernod’s Absolut was not quite as fortunate as UK sales, while positive, failed to bolster the brand and stop overall decline.

Looking further down the table, growth was experienced by 21 out of the 47 million-case brands. There’s not a lot in it – 18 brands declined – but the category will be happy to see the pendulum swing that way for the first time in a number of years.

Other big name brands turn their backs on a fairly underwhelming year. Svedka, Finlandia, Skyy, Grey Goose and Cîroc grew slightly, if at all. Cunnington picks up the point: “The rapid falls and rises are also appearing in the highly competitive US market, with brands such as Ketel One, UV, Aristocrat and Pinnacle suffering declines due to the intense competition. The continued fall of Pinnacle continues to show what a bad deal it was for Beam.”

Now to Ukraine and Russia. The dynamic falls and rises continue and one Russian company has come out of nowhere to become the country’s leading distiller. Founded a few years ago, Status Group bags the three fastest-growing places in this year’s vodka category. In contrast, Alcohol Siberian Group’s Pyat Ozer continues its descent after years of historical growth.

One Russian company that seems to be on an upwards trajectory is Roust – its Russian Standard brand outsold Finlandia for the first time in 2015. Poland might be its largest market, with a 39% share, but global CEO Grant Winterton says the UK continues to remain its key international market as its brands have enjoyed high double-digit growth there for several years.

Some of the CIS countries still pose a problem for the company, says Winterton, “due to the decline in consumer spending and the significant depreciation of the local currencies, following the depreciation in Russia. “Ukraine banned Russian vodka in 2015, which has led to a decrease of imports of our products from Russia to the market.”

A big tussle for third place in the vodka category has historically taken place between Global Spirits’ Khortytsa and Bayadera Group’s Khlibniy Dar. For a long time, the latter was the one to topple with case sales around the 9m mark. Continued sales decline for Khlibniy Dar since 2012 meant Khortytsa was finally able to claim the title last year and it’s held on to that honour this year, following 3% growth.

A million cases now stand between the rivals and if Global Spirits has anything to say about it, it will

be more next year. The company increased its sales in the US from 10 to 22 states in 2015, resulting in a 300% increase in sales. It’s set its sights on a further eight states next year.